what about this script?

I created this script as a learning project to improve my Python skills. My goal was to spend a few minutes each day practicing coding, building consistency over time. I've found that the best way to learn programming is by working on a project with a practical purpose—it keeps the motivation high and makes the learning process much more engaging

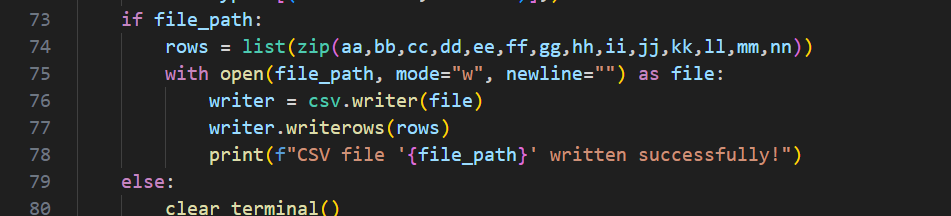

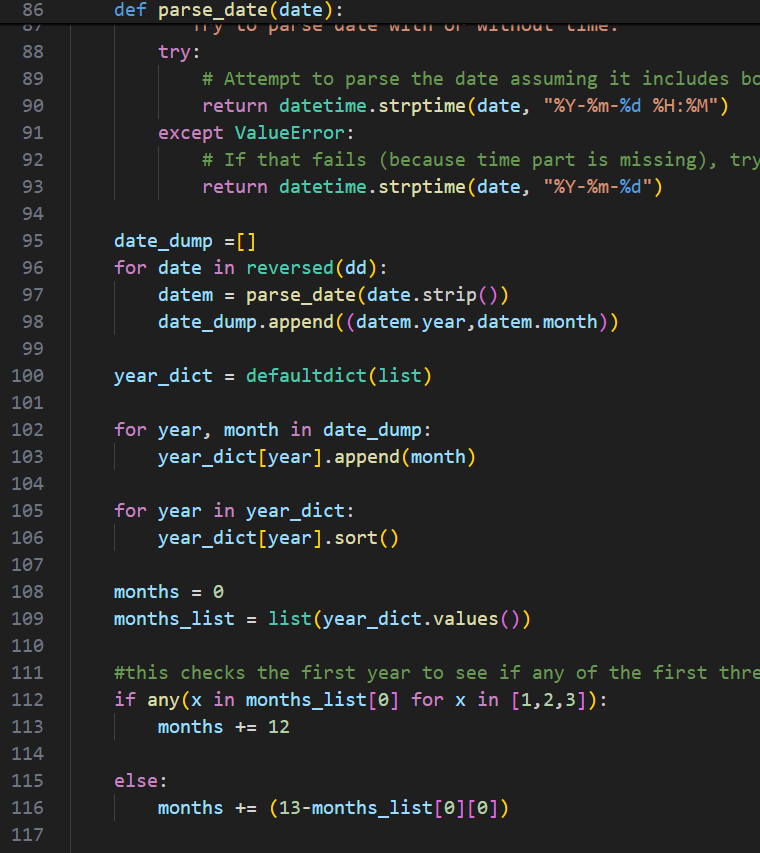

The script processes data from a TradingView list of trades CSV file, allowing you to analyze and gain insights into your trading strategies. It is especially useful for comparing multiple strategies at once, calculating combined drawdown statistics to help you reduce maximum drawdown by using a mix of uncorrelated strategies. This approach smooths out overall performance since some strategies may gain while others lose.

Additionally, the script calculates a reward/risk, “R” value, which compares downside risk to potential net profit. This can be used to gauge one strategy or several of them together. It is computed as:

(average yearly net profit) / (worst drawdown in dollars)

An R value that is twice as high indicates twice the potential upside for the same level of downside risk. This metric is helpful for ranking strategies to decide which ones to pursue.

Many more features have been added. They are all listed in the blog!